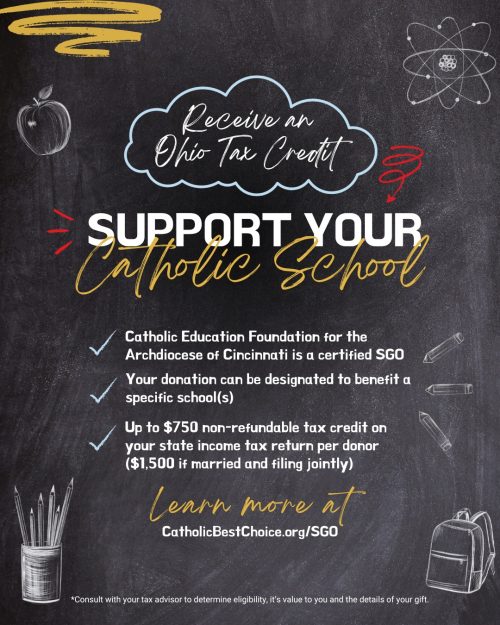

SUPPORT CATHOLIC SCHOOL TUITION FUNDING and receive dollar-for-dollar Tax Credits.

2023 SGO Gifts can be made up to April 15, 2024, to claim and include on your 2023 Tax Return. Donations received by the Scholarship Granting Organization (SGO) on or up to the Federal tax filing deadline of April 15, 2024, may be claimed for the 2023 tax year; however, a credit from this contribution may not be claimed for both the 2023 and 2024 tax filings. For example, if you donate to The Archdiocese of Cincinnati Foundation for Catholic Education during the 2023 calendar year. In that case, you will claim the tax credit on your 2023 tax return when you file your taxes in the spring of 2024. If you donate to The Archdiocese of Cincinnati Foundation for Catholic Education between January 1 and April 15, 2024, you may claim the credit on either your 2023 tax filing OR 2024 tax filing, but not on both.

The Catholic Education Foundation for the Archdiocese of Cincinnati (CEF) is a certified scholarship-granting organization (SGO)! Ohio taxpayers who donate to an SGO may be able to claim a dollar-for-dollar, non-refundable tax credit on their state income tax return for up to $750 per donor (up to $1,500 if married and filing jointly).

The donor may designate the gift to a specific participating school (select St. Mary School Hyde Park!) or to the general fund for the Catholic Education Foundation. All schools have been included as participating unless the school notifies otherwise. Collected funds will be distributed twice a year to the designated schools along with a listing of donors unless an individual asks to remain anonymous.

To learn more and to participate, visit: https://catholicbestchoice.org/sgo/

PLEASE NOTE: According to a representative from the Ohio Department of Taxation, if you file a married joint return, each taxpayer would need to make their own $750 contribution to claim the maximum of $1,500. Separate acknowledgment letters will be provided for documentation of your gifts.